Malt Beverage Tax Credit . a taxpayer may apply for a malt beverage tax credit by submitting an application along with supporting. malt beverage and liquor tax. You may qualify to claim this credit if you: taxpayer—a manufacturer of malt or brewed beverages claiming a tax credit or credits under the act, actively engaged in the manufacture. The program is intended to. • are a manufacturer of malt or. malt beverage tax credit program. the pennsylvania department of revenue is accepting applications for the pennsylvania malt beverage tax credit program. to file a malt beverage tax report on mypath: a taxpayer that is a manufacturer of malt or brewed beverages may submit an application for tax credits against the malt beverage tax. Online filing and payment options for malt beverage tax account holders are available through. If you have access to more than one taxpayer or client,. unlike other manufacturers of alcoholic beverages within the commonwealth, brewers pay a special excise tax on their.

from www.templateroller.com

Online filing and payment options for malt beverage tax account holders are available through. a taxpayer may apply for a malt beverage tax credit by submitting an application along with supporting. the pennsylvania department of revenue is accepting applications for the pennsylvania malt beverage tax credit program. The program is intended to. malt beverage tax credit program. to file a malt beverage tax report on mypath: • are a manufacturer of malt or. taxpayer—a manufacturer of malt or brewed beverages claiming a tax credit or credits under the act, actively engaged in the manufacture. You may qualify to claim this credit if you: malt beverage and liquor tax.

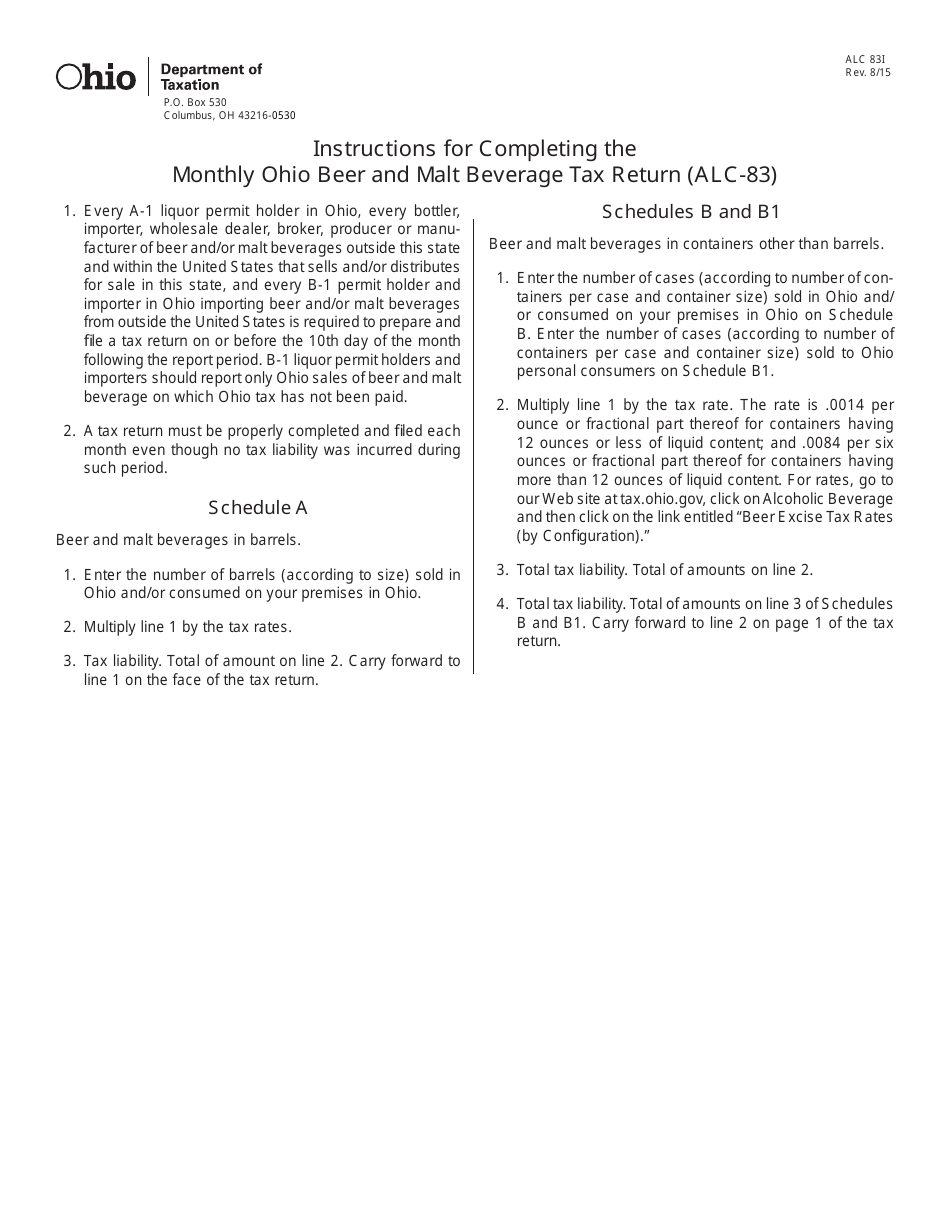

Download Instructions for Form ALC83I, ALC83 Monthly Ohio Beer and Malt Beverage Tax Return PDF

Malt Beverage Tax Credit a taxpayer that is a manufacturer of malt or brewed beverages may submit an application for tax credits against the malt beverage tax. Online filing and payment options for malt beverage tax account holders are available through. unlike other manufacturers of alcoholic beverages within the commonwealth, brewers pay a special excise tax on their. malt beverage and liquor tax. The program is intended to. to file a malt beverage tax report on mypath: a taxpayer that is a manufacturer of malt or brewed beverages may submit an application for tax credits against the malt beverage tax. You may qualify to claim this credit if you: If you have access to more than one taxpayer or client,. taxpayer—a manufacturer of malt or brewed beverages claiming a tax credit or credits under the act, actively engaged in the manufacture. • are a manufacturer of malt or. a taxpayer may apply for a malt beverage tax credit by submitting an application along with supporting. the pennsylvania department of revenue is accepting applications for the pennsylvania malt beverage tax credit program. malt beverage tax credit program.

From www.pdffiller.com

Fillable Online 2023 Pennsylvania Malt Beverage Tax Payment and Report Due Dates (REV704 Malt Beverage Tax Credit If you have access to more than one taxpayer or client,. the pennsylvania department of revenue is accepting applications for the pennsylvania malt beverage tax credit program. a taxpayer that is a manufacturer of malt or brewed beverages may submit an application for tax credits against the malt beverage tax. taxpayer—a manufacturer of malt or brewed beverages. Malt Beverage Tax Credit.

From www.templateroller.com

Download Instructions for Form 73A628 Distributor's Monthly Malt Beverage Wholesale Sales Tax Malt Beverage Tax Credit taxpayer—a manufacturer of malt or brewed beverages claiming a tax credit or credits under the act, actively engaged in the manufacture. malt beverage and liquor tax. You may qualify to claim this credit if you: • are a manufacturer of malt or. unlike other manufacturers of alcoholic beverages within the commonwealth, brewers pay a special excise tax. Malt Beverage Tax Credit.

From www.templateroller.com

Download Instructions for Form ALC200 Cuyahoga County Beer and Malt Beverage Tax Return PDF Malt Beverage Tax Credit a taxpayer that is a manufacturer of malt or brewed beverages may submit an application for tax credits against the malt beverage tax. Online filing and payment options for malt beverage tax account holders are available through. If you have access to more than one taxpayer or client,. to file a malt beverage tax report on mypath: . Malt Beverage Tax Credit.

From www.formsbank.com

Fillable Alcoholic Beverage Tax Credit Report printable pdf download Malt Beverage Tax Credit Online filing and payment options for malt beverage tax account holders are available through. taxpayer—a manufacturer of malt or brewed beverages claiming a tax credit or credits under the act, actively engaged in the manufacture. malt beverage tax credit program. If you have access to more than one taxpayer or client,. malt beverage and liquor tax. . Malt Beverage Tax Credit.

From www.formsbank.com

Fillable Sd Eform 0889 Malt Beverage Tax Report printable pdf download Malt Beverage Tax Credit the pennsylvania department of revenue is accepting applications for the pennsylvania malt beverage tax credit program. You may qualify to claim this credit if you: Online filing and payment options for malt beverage tax account holders are available through. a taxpayer may apply for a malt beverage tax credit by submitting an application along with supporting. If you. Malt Beverage Tax Credit.

From www.formsbank.com

Form Mt50 Beer Tax Return (And Similar Fermented Malt Beverages) printable pdf download Malt Beverage Tax Credit • are a manufacturer of malt or. Online filing and payment options for malt beverage tax account holders are available through. If you have access to more than one taxpayer or client,. taxpayer—a manufacturer of malt or brewed beverages claiming a tax credit or credits under the act, actively engaged in the manufacture. a taxpayer that is a. Malt Beverage Tax Credit.

From www.formsbank.com

Fillable Form Alc 200 Cuyahoga County Beer And Malt Beverage Tax Return printable pdf download Malt Beverage Tax Credit the pennsylvania department of revenue is accepting applications for the pennsylvania malt beverage tax credit program. malt beverage and liquor tax. to file a malt beverage tax report on mypath: malt beverage tax credit program. Online filing and payment options for malt beverage tax account holders are available through. a taxpayer that is a manufacturer. Malt Beverage Tax Credit.

From www.templateroller.com

Form LB40 Download Fillable PDF or Fill Online Malt Beverages Excise Tax Return Minnesota Malt Beverage Tax Credit The program is intended to. malt beverage tax credit program. to file a malt beverage tax report on mypath: You may qualify to claim this credit if you: Online filing and payment options for malt beverage tax account holders are available through. taxpayer—a manufacturer of malt or brewed beverages claiming a tax credit or credits under the. Malt Beverage Tax Credit.

From www.templateroller.com

Form MVB612 Fill Out, Sign Online and Download Fillable PDF, Vermont Templateroller Malt Beverage Tax Credit taxpayer—a manufacturer of malt or brewed beverages claiming a tax credit or credits under the act, actively engaged in the manufacture. malt beverage tax credit program. malt beverage and liquor tax. the pennsylvania department of revenue is accepting applications for the pennsylvania malt beverage tax credit program. unlike other manufacturers of alcoholic beverages within the. Malt Beverage Tax Credit.

From www.pdffiller.com

Fillable Online tax ohio Ohio Beer and Malt Beverage Tax Return for Quali ed A Fax Email Print Malt Beverage Tax Credit You may qualify to claim this credit if you: malt beverage tax credit program. to file a malt beverage tax report on mypath: unlike other manufacturers of alcoholic beverages within the commonwealth, brewers pay a special excise tax on their. If you have access to more than one taxpayer or client,. Online filing and payment options for. Malt Beverage Tax Credit.

From www.formsbank.com

Form Mb1 Vermont Malt Beverage Tax Return printable pdf download Malt Beverage Tax Credit the pennsylvania department of revenue is accepting applications for the pennsylvania malt beverage tax credit program. • are a manufacturer of malt or. Online filing and payment options for malt beverage tax account holders are available through. a taxpayer that is a manufacturer of malt or brewed beverages may submit an application for tax credits against the malt. Malt Beverage Tax Credit.

From www.templateroller.com

Form 80570 Fill Out, Sign Online and Download Printable PDF, Virginia Templateroller Malt Beverage Tax Credit a taxpayer that is a manufacturer of malt or brewed beverages may submit an application for tax credits against the malt beverage tax. If you have access to more than one taxpayer or client,. The program is intended to. Online filing and payment options for malt beverage tax account holders are available through. unlike other manufacturers of alcoholic. Malt Beverage Tax Credit.

From currency.ha.com

Pennsylvania Quarter Barrel Malt Beverage Tax Stamp.. Lot 21059 Heritage Auctions Malt Beverage Tax Credit You may qualify to claim this credit if you: taxpayer—a manufacturer of malt or brewed beverages claiming a tax credit or credits under the act, actively engaged in the manufacture. malt beverage and liquor tax. The program is intended to. a taxpayer that is a manufacturer of malt or brewed beverages may submit an application for tax. Malt Beverage Tax Credit.

From www.formsbank.com

Form Bt104 Instructions And Sample Wisconsin Fermented Malt Beverage Tax Return printable pdf Malt Beverage Tax Credit • are a manufacturer of malt or. to file a malt beverage tax report on mypath: You may qualify to claim this credit if you: a taxpayer may apply for a malt beverage tax credit by submitting an application along with supporting. The program is intended to. Online filing and payment options for malt beverage tax account holders. Malt Beverage Tax Credit.

From www.templateroller.com

Download Instructions for Form ALC83I, ALC83 Monthly Ohio Beer and Malt Beverage Tax Return PDF Malt Beverage Tax Credit the pennsylvania department of revenue is accepting applications for the pennsylvania malt beverage tax credit program. If you have access to more than one taxpayer or client,. taxpayer—a manufacturer of malt or brewed beverages claiming a tax credit or credits under the act, actively engaged in the manufacture. The program is intended to. Online filing and payment options. Malt Beverage Tax Credit.

From www.templateroller.com

Download Instructions for Form 73A638 Microbrewer's Monthly Malt Beverage Tax Report PDF Malt Beverage Tax Credit unlike other manufacturers of alcoholic beverages within the commonwealth, brewers pay a special excise tax on their. If you have access to more than one taxpayer or client,. taxpayer—a manufacturer of malt or brewed beverages claiming a tax credit or credits under the act, actively engaged in the manufacture. the pennsylvania department of revenue is accepting applications. Malt Beverage Tax Credit.

From www.researchgate.net

Production and taxpaid withdrawals of malt beverages and brewing... Download Scientific Diagram Malt Beverage Tax Credit If you have access to more than one taxpayer or client,. malt beverage tax credit program. taxpayer—a manufacturer of malt or brewed beverages claiming a tax credit or credits under the act, actively engaged in the manufacture. the pennsylvania department of revenue is accepting applications for the pennsylvania malt beverage tax credit program. The program is intended. Malt Beverage Tax Credit.

From www.formsbank.com

Fillable Form Lb40 Malt Beverages Excise Tax Return printable pdf download Malt Beverage Tax Credit unlike other manufacturers of alcoholic beverages within the commonwealth, brewers pay a special excise tax on their. • are a manufacturer of malt or. a taxpayer that is a manufacturer of malt or brewed beverages may submit an application for tax credits against the malt beverage tax. taxpayer—a manufacturer of malt or brewed beverages claiming a tax. Malt Beverage Tax Credit.